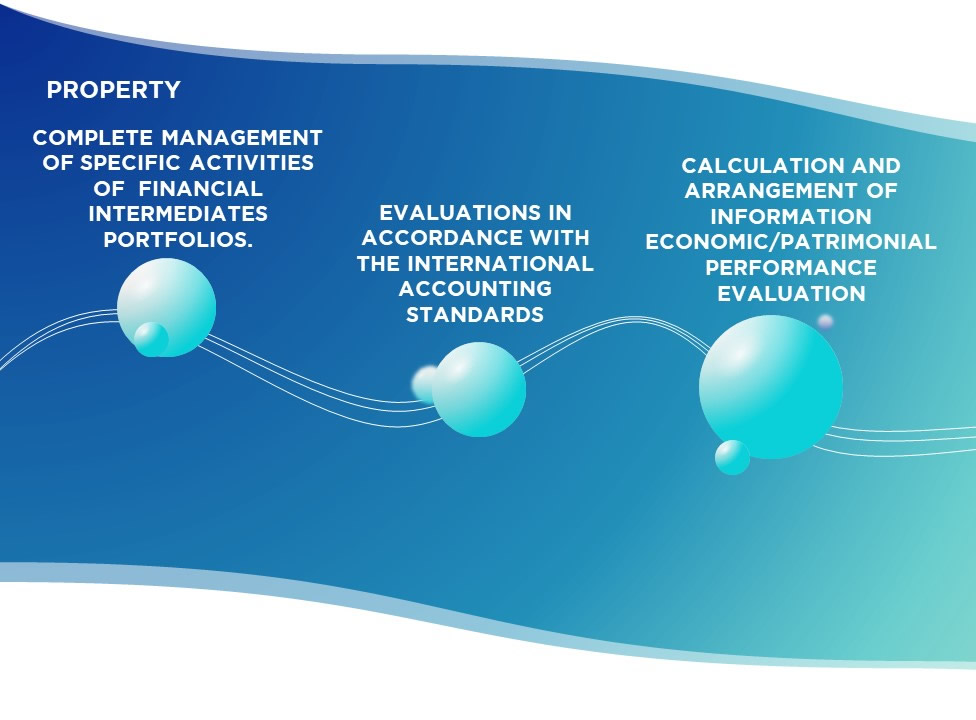

Property

Property

The search for a common language in business so that companies can make comparisons at an international level has become a reality with the establishment of International Financial Reporting Standards (IFRS), which have replaced various national rules in Europe and will become the basis on which the entire world will eventually standardise.

As a result of the financial crisis, supervisory organs are continuing to work towards issuing measures (Basel, Solvency) for the prudential regulation of the banking sector and to improve the effectiveness of surveillance actions and the ability of financial institutions to manage the risks they take.

Managing the assets in entity' portfolios is an extremely delicate operation and requires a good knowledge of the markets, careful attention to risk and an accurate analysis of their own portfolio.

The Property module meets the many needs linked to this type of operability.

Main Features

- Produces statements and financial statement notes according to IAS principles.

- Provides the users with reports and information query functions.

italiano

italiano english

english español

español